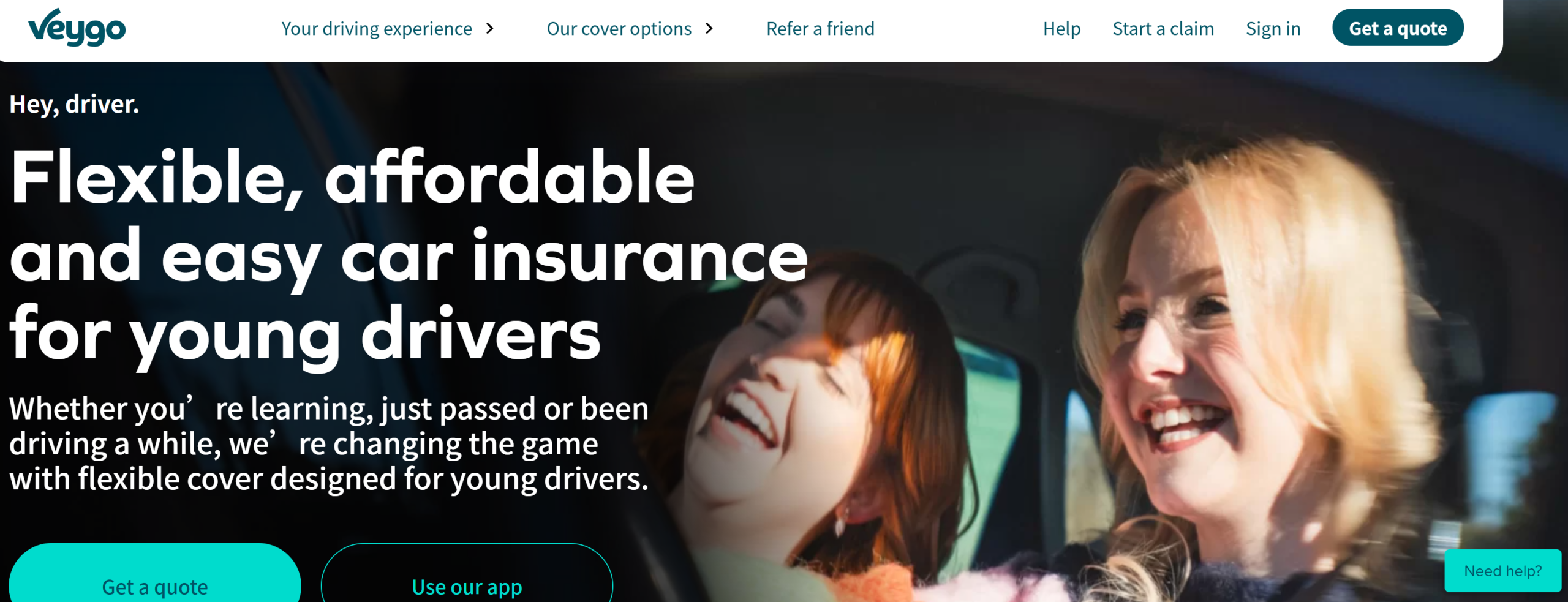

Brand Introduction

Veygo is a UK-based insurance brand specialising in short-term, flexible car cover that adapts to modern driving lifestyles. Through its website (https://www.veygo.com/) you’ll find Veygo offers cover “by the hour, day or week,” or through a monthly rolling subscription, rather than committing to a full year of insurance.

Founded in 2016, Veygo has rapidly built a strong reputation in the UK market. Their “About Us” page states they have sold over 4 million policies since launch — a clear indicator of scale and acceptance. They are also part of the prominent Admiral Group (a major UK insurance group), which gives them both innovation-driven flexibility and traditional insurance backing.

Veygo caters especially to three main driver categories:

- Learner drivers who need practice cover (even in someone else’s car) (see “Learner driver insurance” product)

- New drivers (just passed their test, first year of driving)

- Experienced drivers who want flexible or temporary cover rather than a full annual policy

The key proposition of Veygo is: pay only for the cover you need, when you need it — instead of paying for a full year even if you drive infrequently. Their product range includes temporary car insurance (hours/days/weeks) and monthly rolling cover which you can cancel at any time.

From a consumer viewpoint, this model is especially appealing for: borrowing or sharing a car, doing extra practice before a driving test, using a car temporarily, or simply being a driver who doesn’t use a vehicle frequently. The website emphasises you can get a quote and cover in minutes.

Overall, Veygo positions itself as a modern alternative to traditional annual car insurance — more aligned with changing lifestyles, student or learner circumstances, and short-term car use.

Customer Reviews

Here are some real user voices reflecting what people appreciate about Veygo’s services.

✅ Ease of Setup & Speed

A large number of reviews highlight how simple it is to get a quote and arrange cover quickly. For example, on Trustpilot one user writes:

“Very easy to set up, will definitely use again.”

Another one:

“Super quick super easy!!”

These comments show that for many users, Veygo delivers minimal fuss and fast onboarding, which is often critical for short-term needs.

✅ Value for Money for Learners / Occasional Drivers

Many users appreciate that they only pay for what they need, rather than a full year. From SmartMoneyPeople:

“When you just need a short amount of insurance, this is a very easy to use, cheap company that serves your needs. Highly recommended!”

Similarly, examples like buying 2-hour policies on weekends instead of a £1,200 annual policy for a learner driver have been cited.

This highlights Veygo’s strength for learners, occasional drivers and cost-sensitive users.

✅ Flexibility & App / Notification Features

Several users mention appreciation for Veygo’s app and real-time notifications. From App Store review:

“I have been using this app for almost 2 years … I had my learner insurance with Veygo … the app helps when I can’t find a suitable quote! … Veygo never let me down!”

Another Trustpilot reviewer:

“Very easy to use … I like how there’s a live notification so you don’t have to go back onto the app to see how much cover you’ve got left.”

The convenience of mobile management and live updates adds to the positive user experience.

✅ Transparent Cover Features & No Claims Bonus Protection

Veygo makes clear that their learner driver cover won’t affect someone else’s no-claims bonus if you’re practising in their car.

This is important feedback for families, learners and car owners who lend their vehicle.

Summary of what users like most:

- Fast, easy quoting and cover setup

- Good value for short term / learner use

- App & mobile friendly experience

- Transparent terms regarding no-claims bonus / borrowing cars

Of course, for full transparency: some reviews raise concerns (for example about the claims process) but the overall tone of the user base is positive. Location: UK.

Current Offers & Highlights (Discounts / Advantages)

When considering using Veygo, it’s useful to know both the “offers” (in the sense of what advantages you get) and some of the current product highlights. Insurance doesn’t always have classic “discount codes” like retail, but here are the key points.

1. Pay-for-what-you-need Model

One of the main advantages (effectively a built-in offer) is that you can buy cover from as little as 1 hour up to several days. Their FAQ states temporary cover “can range from just 1 hour up to 60 days.”

This means for occasional use, you may pay far less than a full year premium.

2. Monthly Rolling Cover

If you don’t want a year-long policy but might drive somewhat regularly, Veygo offers monthly rolling cover which you can cancel at any time, giving more flexibility than conventional annual insurance.

This can be a valuable “offer” for drivers who use their vehicle intermittently, for example students, temporary workers, or second-cars.

3. Learner Driver Discount & No Claims Bonus Protection

For learner drivers, Veygo offers features such as:

- Cover for practising in someone else’s car without affecting the owner’s no-claims bonus.

- After passing the driving test, you can receive 10% off one of their new driver policies (as per their learner driver product page) when you pass.

These are strong benefits for the learner / new driver category.

4. Strong Customer Ratings

Although not a traditional “discount”, it’s worth drawing attention to their strong customer feedback: a Trustpilot TrustScore of ~4.6/5 in thousands of reviews.

High ratings can be considered a “value add” in insurance selection.

5. Best Times & Strategies to Use Veygo

- If you are borrowing someone’s car for a short period (holiday, weekend trip), choose the temporary cover option rather than annual insurance.

- If you’re a learner intending to practice a few hours regularly, intermittent cover (even 1-hour blocks) may cost much less than being added as a named driver or signing up for full cover.

- For new drivers (just passed test) who don’t yet drive daily, the rolling monthly plan can give flexibility until you commit to longer-term coverage.

- Always check the vehicle, driver status, car ownership details (especially if borrowing or sharing someone else’s car) since Veygo’s terms emphasise correct declaration.

6. Quick Summary of Offers & Advantages

- Cover from 1 hour to 60 days under temporary cover.

- Monthly subscription model you can cancel at any time.

- Learner driver benefits: practice cover, 10% off new driver policy post-test.

- Strong backing and customer trust (Admiral Group, high Trustpilot score).

- Lower cost option for short/occasional use vs full annual policies.